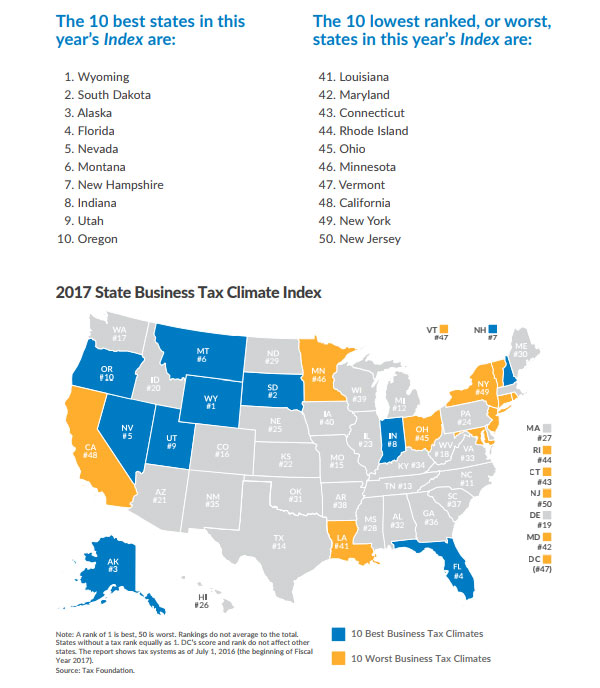

2017 State Business Tax Climate Index

Ohio The Heart-less Of It All

By Tax Foundation

October 1st 2017

Executive Summary

The Tax Foundation’s State Business Tax Climate Index enables business leaders, government policymakers, and taxpayers to gauge how their states’ tax systems compare. While there are many ways to show how much is collected in taxes by state governments, the Index is designed to show how well states structure their tax systems, and provides a roadmap for improvement. The 10 best states in this year’s Index are:

- Wyoming

- South Dakota

- Alaska

- Florida

- Nevada

- Montana

- New Hampshire

- Indiana

- Utah

- Oregon

The absence of a major tax is a common factor among many of the top ten states. Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax. Wyoming, Nevada, and South Dakota have no corporate or individual income tax (though Nevada imposes gross receipts taxes); Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire, Montana, and Oregon have no sales tax. This does not mean, however, that a state cannot rank in the top ten while still levying all the major taxes. Indiana and Utah, for example, levy all of the major tax types, but do so with low rates on broad bases. The 10 lowest ranked, or worst, states in this year’s Index are:

- Louisiana

- Maryland

- Connecticut

- Rhode Island

- Ohio

- Minnesota

- Vermont

- California

- New York

- New Jersey

The states in the bottom 10 tend to have a number of shortcomings in common: complex, non-neutral taxes with comparatively high rates. New Jersey, for example, is hampered by some of the highest property tax burdens in the country, is one of just two states to levy both an inheritance tax and an estate tax, and maintains some of the worst-structured individual income taxes in the country.

Table 1. 2017 State Business Tax Climate Index Index Ranks and Component Tax Ranks

CLICK HERE TO READ ENTIRE REPORT HERE

-30-

FOLLOW PRESIDENT TRUMP ON TWITTER:

-30-

Facebook Pages and Groups for You to “Like and Share”

Marietta Oh 9-12 Project

Guernsey County 9-12 Project

Noble County 9-12

Monroe County-9-12

Morgan County-9-12

Muskingum County 9-12